Shopkeeper, two others sentenced for selling sub standard Patanjali product

Shopkeeper, two others sentenced for selling sub standard Patanjali product

B.D.Kasniyal

Pithoragarh, May 19

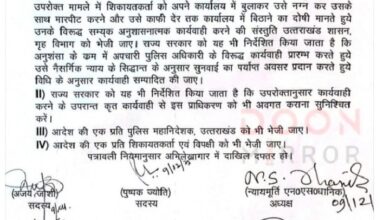

Pithoragarh Chief Judicial Magistrate Sanjay Singh has sentenced, two workers of Patanjali Ayurved limited of Yog Guru Ramdev with fine and imprisonment for violating food security standards in ‘Patanjali Navratna soon papri’, produced and distributed by them.

“While the shop keeper, Liladhar Pathak of Berinag town of Pithoragarh district who was selling the product was sentenced to six months imprisonment with a fine of Rs 5000 other two workers, assistant manager and company representative, of Kanhaji distributors namely Ajay Joshi and assistant manager with manufacturing firm, Abhishek Kumar have been sentenced to six months imprisonment with a fine of Rs 10000 and six months imprisonment with a fine of Rs. 25000, respectively,” said Ritesh Verma, Assistant Prosecution Officer, who pleaded for the case.

The culprits were sentenced under section (3) zz,(5) of IPC and section 28, 27 read with section 59 of Food Security and Standard Act 2006.”The samples were collected on October 17, 2019 and decision in the court case came on May 18, 2024,” said Verma, the government councelor.

The case was registered in July 2021 after food samples collected from the shopkeeper, Liladhar Pathak on September 17 ,2019, were found to be below the food security standards after testing in a national laboratory at Gaziabad.”The request of testing of samples in a national laboratory was made by the firm itself,” said Verma.